More Coverage

Twitter Coverage

Satyaagrah

Written on

Satyaagrah

Written on

Satyaagrah

Written on

Satyaagrah

Written on

Satyaagrah

Written on

JOIN SATYAAGRAH SOCIAL MEDIA

"Share our similarities, celebrate our differences": India-Russia economic cooperation extended to payments domain hitting final nail in proverbial coffin of American Card companies, India accepts MIR, Russia accepts RuPay, VISA-MasterCard cry in agony

Financial systems run on trust. This is a reason why credit card companies charge you a higher interest rate than normal. Vice-versa, they should ensure that their consumers feel that these companies won’t leave when you need them most. But, VISA and MasterCard did not abide by this principle. Now they can’t blame MIR and RuPay for replacing them.

MIR-RuPay cards swap

According to reports available in the public domain, the India-Russia economic cooperation is extended to the payments domain. There is a high possibility that within a short period of time, Indian ATMs and PoS terminals will start accepting MIR debit and credit cards. In exchange for India’s opening its gateway for MIR, Russia will remove every kind of hurdle coming in the way of acceptance of RuPay cards in the Soviet territory.

Indian ATMs and terminals may soon start accepting Russian Mir debit and credit cards, India’s Deccan Herald news outlet reported on Sunday.

According to the newspaper, in return, Russia is likely to “clear the way” for Indian RuPay cards to be accepted in the country. Currently, the parties are also reportedly discussing options for the mutual implementation of interbank transfer services, India’s Unified Payments Interface (UPI), and SPFS, the Russian version of SWIFT.

In addition, according to the news outlet, India and Russia are continuing negotiations on expanding the use of national currencies in bilateral trade and discussing creating a new reserve currency within BRICS.

|

Russian Deputy Foreign Minister Alexander Pankin has also confirmed that Moscow was negotiating with New Delhi on the use of Mir cards.

“The unjustified blocking of all Russian clients by the largest international card payment systems has made it important to expand the geography of Mir cards. We are actively working in this direction,” he said last week, adding that discussions about this matter are also being held with Egypt, China, Azerbaijan, Bahrain, Cuba, Myanmar, Nigeria, and Thailand.

Russian Mir payment cards currently can be used in 11 countries: Abkhazia, Armenia, Belarus, Vietnam, Kazakhstan, Kyrgyzstan, Tajikistan, Turkey, Uzbekistan, South Korea, and South Ossetia.

In the last week, various developments in this regard have been reported. Firstly, Ajit Doval paid a sudden visit to Russia.

|

The fact that the National Security advisor met with the Russian Minister of Industry and Trade added fuel to the fire around the MIR-RuPay exchange.

|

Rupee-Rouble is just around the corner

Moreover, 15 Russian banks are negotiating with Indian banks for sorting out issues related to Rupee-Rouble transactions in bilateral trade.

According to a report by The Economic Times, Petersburg Social Commercial Bank, Zenit Bank, and Tatsotsbank are some of the banks involved in negotiations from the Russian side. From the Indian side, SBI, Bank of India, Canara Bank, Uco Bank, Bank of Baroda among others are leading the discussion.

|

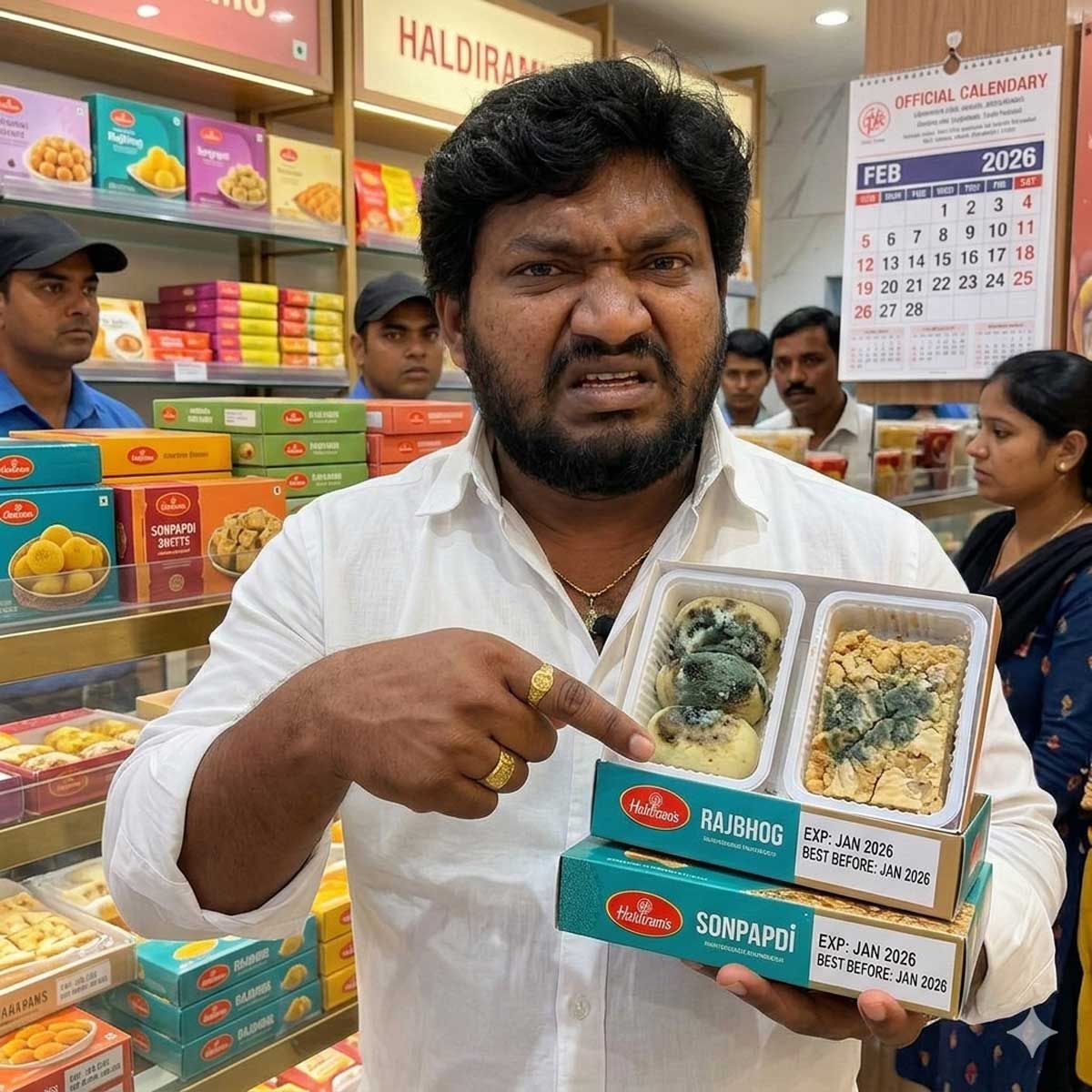

VISA and MasterCard losing big

The collaboration between India and Russia may end up hitting the final nail in the proverbial coffin of American Card companies like VISA and MasterCard. Earlier this year, both these companies felt compelled to participate in the faux sanction regime of the United States. They suspended their operations in Russia. The bankruptcy of pragmatism may end up making them financially bankrupt.

Though MIR was carving out its own niche in Russia, its growth was slow. After its inception in 2014, which was necessitated by Crimea-related sanctions, MIR cards could only dominate 12 percent of Russian markets between 2016-2020.

On the other hand, the combined share of VISA and MasterCard was more than 80 percent. The moment both these companies decided to leave Russia in times of its need, they lost millions of customers, resulting in an annual revenue loss to the tune of $1.5 billion.

|

Suicidal attempts by American companies

The self-goal by VISA and MasterCard looks more foolish when you consider the fact that both were already on a losing spree in the Indian market. The introduction of RuPay cards and the financial inclusion drive of the Indian government had already snatched a major section of its market share in the Indian Card market.

By the end of 2020, RuPay had released more than 60.3 crore cards. Its debit Card is particularly popular among the Indian masses. With the linking of UPI with RuPay credit cards, it is ready to eat into the remaining 80 percent share of foreign credit card issuers as well.

Though it is bad for American card companies, it did not come off as a surprise. There was a certain inevitability to it. Yes, it is true that companies should abide by the principles of governments of their foundational jurisdiction.

However, it is also true that the government is not always right. These companies knew that sanctions were futile and still they participated in it. They handed their failures on a platter.

rt.com

Support Us

Support Us

Satyagraha was born from the heart of our land, with an undying aim to unveil the true essence of Bharat. It seeks to illuminate the hidden tales of our valiant freedom fighters and the rich chronicles that haven't yet sung their complete melody in the mainstream.

While platforms like NDTV and 'The Wire' effortlessly garner funds under the banner of safeguarding democracy, we at Satyagraha walk a different path. Our strength and resonance come from you. In this journey to weave a stronger Bharat, every little contribution amplifies our voice. Let's come together, contribute as you can, and champion the true spirit of our nation.

|  |  |

| ICICI Bank of Satyaagrah | Razorpay Bank of Satyaagrah | PayPal Bank of Satyaagrah - For International Payments |

If all above doesn't work, then try the LINK below:

Please share the article on other platforms

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text. The website also frequently uses non-commercial images for representational purposes only in line with the article. We are not responsible for the authenticity of such images. If some images have a copyright issue, we request the person/entity to contact us at This email address is being protected from spambots. You need JavaScript enabled to view it. and we will take the necessary actions to resolve the issue.

Related Articles

- ‘Modi cannot be intimidated to take any decision against India interests’: Vladimir Putin applauds Modi's unyielding leadership, confirms bilateral relations thrive under Modi’s visionary policies, placing India on the global stage of impactful diplomacy

- "Zara ahista mar tamacha-e-zindagi, Chehre pe nishaan dikhne lage hain": Russian court fined $374 million to American search giant Google for its failure to delete prohibited information on conflict in Ukraine, ask to remove all “misleading information”

- "I took a speed-reading course and read War and Peace in twenty minutes. It involves Russia": In a grand ceremony led by President Vladimir Putin, Russia annexed four regions of Ukraine, after results of referendums showed overwhelming support

- "Patience lightens the burthen we cannot avert": Prime Minister Narendra Modi's views on the use of nuclear weapons had an impact on the Russians and could well have averted a global disaster in the context of the Ukraine war: Bill Burns, CIA - Director

- "War is costly, peace is priceless": India's pivotal role in BRICS is shaping the narrative amid Ukraine crisis, championing dialogue and diplomacy, its influence in fostering global harmony is becoming increasingly evident on the international stage

- "The hardest thing in life to learn is which bridge to cross and which to burn": Russian anti-terrorism confirms truck bombing damaged strategic Crimean Bridge that connects peninsula with mainland Russia, Mikhail Podoliak tweeted blast as “the beginning”

- "Don’t be mad at the mirror if you are ugly": Russian energy giant Gazprom and National Iranian Oil Company signed a $40-billion MOU on President Putin visit, West sanctions tried to limit funding to Russia that might be used for war against Ukraine

- "The secret of politics? Make a good treaty with Russia": Our response will be harsh, says Putin hours after missiles & drones rained hitting military, energy, & communications targets in response to Crimea bridge attack in Kyiv and other Ukrainian cities

- “A crisis is an opportunity riding a dangerous wind”: Russian President Vladimir Putin - 'Moscow is ready to resume gas supplies to Europe via a link of Germany-bound Nord Stream 2 pipeline under the Baltic Sea, but will not sell oil at a lower price cap'

- Vladimir Putin visiting India in December, as Trump’s bullying tariffs try to corner New Delhi, yet Modi strengthens energy and defence ties with Moscow, showing India will not bow to U.S. pressure and will guard its strategic independence

- "If saving money is wrong, I don't want to be right!": Central Vista to save the govt around Rs 1000 crore per annum in rent and other associated costs, still faced opposition from political parties, environmental activists and civil society organizations

- "In all chaos there is a cosmos, in all disorder a secret order": The Symphony of Governance, Architectural Marvel and Divine Geometry: Prime Minister Modi inaugurates the Sri Yantra-Inspired Majestic New Parliament amid chants of shlokas & sacred mantras

- "As dreams meet destiny, the world watches with bated breath": Srinagar beams under the global spotlight as the enchanting Kashmir readies for Miss World 2023, 'Mind-blowing' echoes Karolina Bielawska, encapsulating the valley's mesmerizing allure

- “From Gandhi to Godse; From lions sitting peacefully to Angry lions with bared fangs. This is Modi’s new India”: How 'liberals' get unrealistic to criticize Modi and their claim of changed National Emblem is nothing else other than an utter lie

- "Bad news travels fast. Good news takes the scenic route": BIG BREAKING - Russia's most dominant lender, SBERBANK launches RUPEE account; says individuals can now open accounts in Indian rupees throughout its vast network in Russia and abroad