More Coverage

Twitter Coverage

Satyaagrah

Written on

Satyaagrah

Written on

Satyaagrah

Written on

Satyaagrah

Written on

Satyaagrah

Written on

JOIN SATYAAGRAH SOCIAL MEDIA

"Unless both sides win, no agreement can be permanent": De-dollarisation of international energy trade gains momentum - India-Russia trade to be in Rupee-Rouble as bilateral trade increased by more than 200% in YoY terms reaching the peak of its potential

India-Russia trade is reaching the peak of its potential. Within 9 months of this financial year, bilateral trade has increased by more than 200 per cent in YoY terms. Apart from strengthening bilateral relations, it has also set the tone for Rupee-Rouble trade.

|

India-Russia trade in Rupee-Rouble

Russia’s VTB bank has launched a mechanism to receive direct payment in Rupees. VTB is the second largest bank of Russia and the Russian government has a major stake in it. With the new system, Russian businesses will be able to transact with Indian companies in Rupee. It has eliminated the need for including Dollar and Euro in bilateral trade.

The move is a promising one since India-Russia trade within the first 9 months of this financial year clocked $27 billion. It is easily expected to cross $30 billion at the end of this year. The numbers surged because India drastically increased its imports of coal, oil and fertilisers from Russia. Due to this, India has a trade deficit with Russia, since more than 90 per cent of bilateral trade is dominated by Russian exports to India.

India has raised this issue and Russians have been positive in their approach to India’s concerns. The bonhomie is another good sign for Rupee-Rouble trade.

Boost to de-Dollarisation of currency system

Bilateral trade in local currencies is a joint vision of both countries. Even before the war, they had taken serious efforts to drive it. Before 2019, we used to settle more than 50 per cent of India-Russia trade in Dollars, but in 2021, 53.4 per cent of Indian payments to Russia was made in Rouble while Dollar’s share came down to 38.3 per cent. Russia had agreed to receive payment of $5.2-$5.6 billion in Rupee for delivery of the S-400 Triumf air defence system.

But it is not only Russia. Vostro accounts with respect to Sri Lanka and Mauritius have already been opened. Moreover, India is currently in talks with at least 35 countries for bilateral trade in local currencies. These include key trading partners like UAE and Saudi Arabia.

If bilateral payment settlements in local currencies gain traction, it will be a big boost to the prospects of BRICS currencies as well. Currently, the GDP of this group comprises 23 per cent of Global economy. 18 per cent of global trade is dominated by this group. With increasing trade ties between India-Russia, Russia-China and Saudi Arabia keen to join the group, the de-Dollarisation of this group will set a big precedent for other groups and countries.

In mid-November last year, India announced plans to double the volume of trade with Russia, noting that the transition to settlements in national currencies would only be an additional incentive for this. In late autumn, the Indian authorities allowed the use of Rupees in international trade settlements.

Special ‘Vostro’ accounts are already being opened in Russian banks, in addition, financial institutions from Russia have been allowed to open accounts in Indian banks in Rupees. For Moscow, this is important, given that Russian assets in Dollars and Euros around the world have been seized, and any currency of “unfriendly countries” in Russian accounts can be blocked. However, there are risks: over the past few years, the Rupee has lost over 25% against the Russian Ruble and 10% against the US Dollar.

According to Reuters, from January to August 2022, the trade turnover between Russia and India increased by 130%, reaching US$17 billion. In the same period last year, this figure was US$3.2 billion. The reason for such a sharp increase was the supply of Russian oil to India at deep discounts. New Delhi quadrupled its purchases of oil from Russia. Moscow ousted Riyadh and Baghdad, becoming the largest exporter of this energy resource to India (22% of total imports, or 4.03 million tons).

Overall, Russia has risen from 25th to 7th place in the list of the largest trading partners for India. At the same time, the export of Indian goods to Russia decreased from US$1.31 billion to US$992.7 million. In addition, Russia asked India for help with the supply of several hundred goods that the country cannot buy because of the sanctions imposed against it. The Indian Foreign Minister, Subrahmanyam Jaishankar said that New Delhi is ready to start deliveries of spare parts needed for Russian trains, cars and planes.

At a recent meeting with his Russian counterpart Sergei Lavrov, Jaishankar said that the countries plan to soon bring trade to US$30 billion, a goal set by Indian Prime Minister Narendra Modi and Russian President Vladimir Putin.

The parties also discussed cooperation in the field of nuclear energy and space, as well as the possibilities of military-technical cooperation. In early November, the head of the Kalashnikov concern, Alan Lushnikov, said that the plant for the production of AK-203 assault rifles in India had already begun to produce products.

India meanwhile has resisted pressure from the West and has not joined anti-Russian sanctions. Moscow, in turn, is prepared to establish improved trade and energy deals with states that did not support the introduction of restrictive measures against it. For Russia, this is a step to overcome the sanctions pressure on the economy.

|

Balancing Trade To Help With Ruble-Rupee Disparity

In September 2022, India overtook the UK in terms of GDP and became the fifth economy in the world as from Q1 that year. The country currently provides 3.5% of global GDP and contributes to global economic growth close to that of the US and China. New Delhi has overtaken Washington and Beijing in the speed of economic recovery, but at the same time concedes to them due to the sheer scale of their manufacturing output. However, India now noticeably outperforms all other countries in the world’s top 10 largest economies, including Brazil, Germany and Japan.

The volumes of the products that India supplies to Russia can be expected to increase. These include chemicals (46% in the import structure), machinery and vehicles (30%), food and agricultural raw materials (16%), metals (8%), textiles and footwear (7%), precious metals and stones (2 %). It is likely that sooner or later it will be possible to balance the trade turnover, as India is acquiring increasing Russian raw materials, buying them at discounted prices. Obtaining a better balance in trade turnover will make the ability to trade in Rubles and Rupees increasingly attractive as a means for Russia to reduce its current overbalance of acquiring Rupees when set against the Ruble volumes.

India is therefore highly interesting for the prospects of Russian trade as part of the general “Pivot to Asia” as a result of Western sanctions. The United States, Brussels and Ukraine might not like it, but the reality is that India requires competitive Russian raw materials and energy to fuel its own domestic economy.

Russia-India Bilateral Trade Prospects 2023

In 2021, trade between the countries amounted to US$13.5 billion, with Russian exports making up US$9.1 billion, and imports – US$4.4 billion. Sales of Russian goods more than doubled the reverse flow. In 2022–2023, an even greater bias towards the prevalence of Russian exports of goods over imports from India is likely. This is primarily due to the transfer of part of Russian energy exports to Asia.

Russia is also increasing sales to India of precious metals and products made from them, non-ferrous metallurgy products, pharmaceutical, chemical, rubber industry, electric machines, vehicles, aluminum, and other non-ferrous metals. Pharmaceutical, chemical, and mechanical engineering products are also exported from India to Russia. In addition, there are opportunities to increase the supply of food, fabrics, clothing and footwear to replace foreign suppliers who have left the Russian market.

In addition, India can be used as an important participant in the parallel import of Western goods to Russia. In particular, New Delhi announced that it was ready to supply Russia with spare parts for aviation, automotive, and railway equipment. Thus, for Rupees, Moscow can buy not only Indian, but also foreign products. This reduces Russia’s surplus in trade with India and allows additional use of Rupees. This too will slowly diminish the use of the US dollar in international trade. With the Rupee poised to become more stable – ironically, on the back of India-Russia trade flows, other regional countries with significant trade partnerships with India will also begin to trade in Rupees, further strengthening the currency. These include the UAE, Saudi Arabia, Iraq, Singapore, Hong Kong, and Indonesia – all in India’s top ten trade partners. Smaller regional economies such as Sri Lanka have exclusively begun to use the Indian Rupee in trade.

Ruble-Rupee And Yuan To Spearhead Currency Usage In Asian Trade

This means that part of the Russian-India trade growth and use of Ruble-Rupee trade will contain spill-over effects. While in the short term, Russia may initially acquire more Rupees than it would ideally like, other countries have started to discuss Rupee trade. These include Tajikistan, Cuba, Luxembourg, Mauritius and Sudan keen on rupee trade. While these may appear on the surface to be smaller players, this is just the beginning of a new trend. Also, Tajikistan is a member of the Commonwealth of Independent States (CIS) and trades directly with other CIS members, Luxembourg is a financial offshore power-house in Europe, while Mauritius is developing as a financial services gateway to the pan-African Continental Free Trade Agreement. From these small acorns, more significant Rupee trade may then develop.

If so, then Russian holdings of Indian Rupees held on account as a result of the current trade balance can be expected to appreciate in value, as the Rupee is used more on regional and international trade – benefiting both countries, and in part, allowing Moscow to develop as an Asia international finance centre. The Indian Rupee, along with other Asian currencies such as the Chinese Yuan, and UAE Dirham are already traded on the Moscow Stock Exchange (MOEX). The impact is already being felt: the Chinese Yuan achieved a bigger trading turnover than the Euro on the MOEX by the end of 2022.

The upshot is that the Russian Ruble will take its place alongside the Chinese Yuan and Indian Rupee as the ‘Big Three’ currencies amongst an increasingly significant basket of other Asian currencies, at the expense of the US Dollar and Euro.

This article has been adapted and amended with additional Asian commentary added to an article titled “East, and Only: Russia and India Decided To Increase Cooperation” by Ksenia Loginova that appeared in Russian on the Izvestia newspaper on January 7, 2023.

References:

Support Us

Support Us

Satyagraha was born from the heart of our land, with an undying aim to unveil the true essence of Bharat. It seeks to illuminate the hidden tales of our valiant freedom fighters and the rich chronicles that haven't yet sung their complete melody in the mainstream.

While platforms like NDTV and 'The Wire' effortlessly garner funds under the banner of safeguarding democracy, we at Satyagraha walk a different path. Our strength and resonance come from you. In this journey to weave a stronger Bharat, every little contribution amplifies our voice. Let's come together, contribute as you can, and champion the true spirit of our nation.

|  |  |

| ICICI Bank of Satyaagrah | Razorpay Bank of Satyaagrah | PayPal Bank of Satyaagrah - For International Payments |

If all above doesn't work, then try the LINK below:

Please share the article on other platforms

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text. The website also frequently uses non-commercial images for representational purposes only in line with the article. We are not responsible for the authenticity of such images. If some images have a copyright issue, we request the person/entity to contact us at This email address is being protected from spambots. You need JavaScript enabled to view it. and we will take the necessary actions to resolve the issue.

Related Articles

- In a bold stride towards unprecedented growth, India and Saudi Arabia set sights on a staggering $200 billion trade target, heralding a new age of economic partnership and space collaboration, cementing bonds and fostering mutual prosperity

- "Arctic waters are the new world’s highway": Russia and China seal Arctic trade pact via the Northern Sea Route as nuclear icebreakers halve Europe delivery time, India joins with new Arctic strategy, reshaping global shipping forever

- A fascinating legend of the ethereal Indian cotton which led to Rome losing a significant quantity of its wealth to India

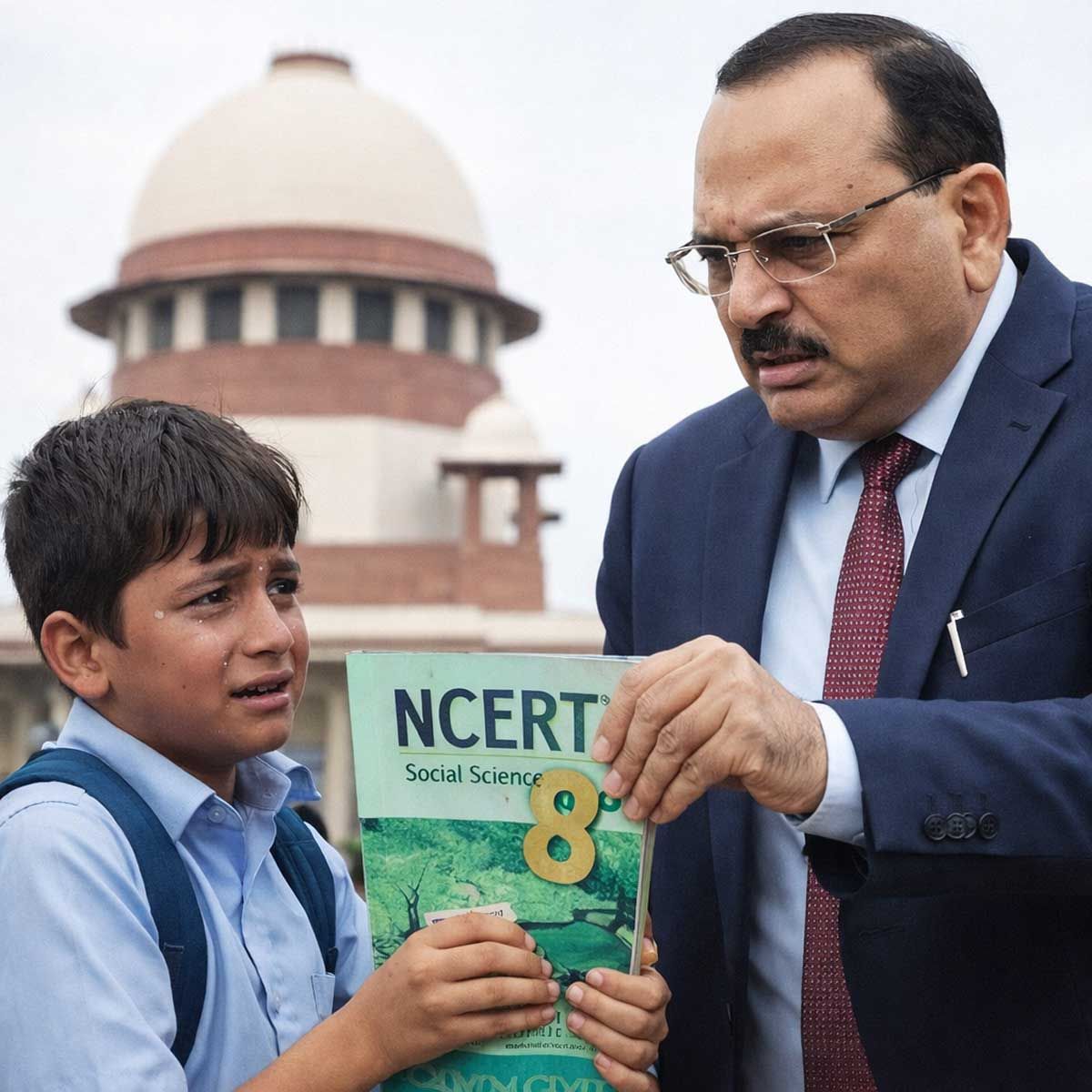

- "There is no path to peace. Peace is the path": NSA Ajit Doval's arrival in Jeddah represents India's commitment to dialogue and diplomacy, his belief - a peaceful resolution to the Ukraine conflict - remains India's utmost priority and greatest desire

- “Trade grows on trust, not threats”: As Trump’s tariffs hurt Americans, Modi and EU leaders seal the historic "mother of all deals" in New Delhi, isolating Washington as India outpaces the US in a shift redefining global trade relations

- We also have views on other people's human rights, particularly when it pertains to our community," Jaishankar retorted in one of the strongest repudiation of the constant American lectures on human rights

- "Greed's frontier: The harsh truth of expansionism": Amid the furore over China releasing a new map, Ex-Chief of Army Staff General Manoj Naravane shared a map of China and took a dig saying "finally someone has got the map of China as it really is"

- Western sanctions on Russia, with 19,535 measures imposed since 2022, aimed to cripple its economy but instead drove alliances with China, India, Iran, and North Korea, boosting trade, diversifying its economy, and weakening Western dominance

- "In unity there is strength; in partnership, there's power": India-UAE economic alliance marks turning point in their shared history, CEPA to boost trade, stimulate investments & fortify economies, advancing both nations towards mutual growth & prosperity

- "Unity in strategy, strength in partnership": Amid China's rising influence in the Indo-Pacific, Germany strengthens military relations with 'reliable' India, eyeing secure trade routes and strategic collaborations while stepping up military ties

- Scripted praise, planned fights: Reports say controversies in Indian Idol are faked to boost TRP after Kishore Kumar episode sparks row

- A Different 9/11: How Vivekananda Won Americans’ Hearts and Minds

- Delhi skies echoed with the sound of roaring engines as @airindia 1139 descended, bringing home 212 Indians from war-torn Israel, chants of 'Vande Matram' & 'Bharat Mata Ki Jai' resonated, celebrating Operation Ajay's triumph for India, that is Bharat

- "I took a speed-reading course and read War and Peace in twenty minutes. It involves Russia": In a grand ceremony led by President Vladimir Putin, Russia annexed four regions of Ukraine, after results of referendums showed overwhelming support

- India – The ‘Church Planting’ Garden