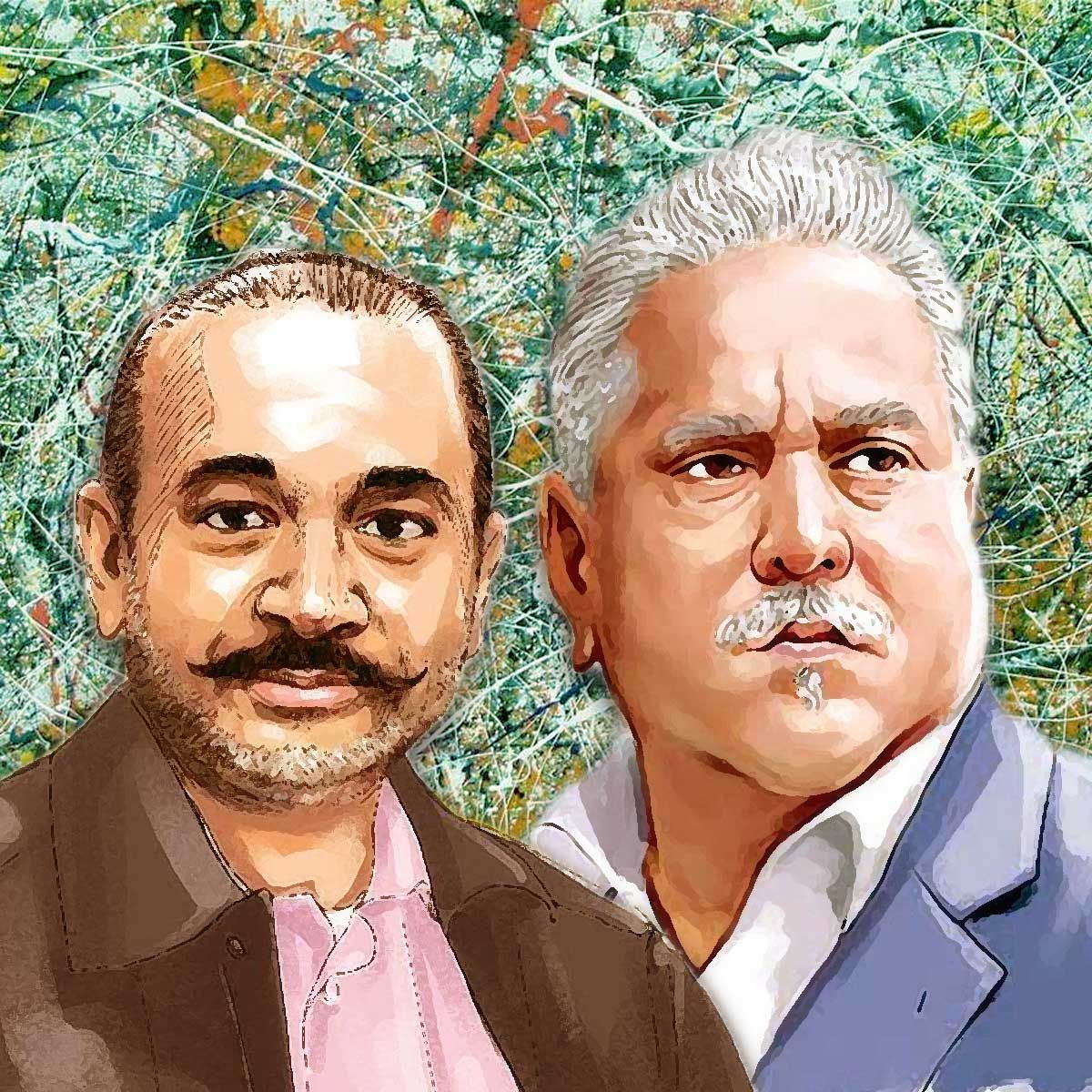

Rs 13k cr recovered by Bank from sale of assets of defaulters like Vijay Mallya and Nirav Modi: FM Nirmala Sitharaman

Union Finance Minister Nirmala Sitharaman on Monday informed how banks have collected roughly Rs 13,109 crore from asset sales of defaulters such as fugitive diamantaire Nirav Modi, Mehul Choksi, and erstwhile liquor baron Vijay Mallya. The assets were seized by the Enforcement Directorate in accordance with the Anti-Money Laundering Act (PMLA).

The Finance Minister further informed today that in the last seven years, bad loans have been resolved for a total of Rs 5.49 lakh crore. Only two states having a negative cash balance indicates that the rest of the states in the country have significant cash balances, said the FM.

She remarked this in response to a question about the second batch of Supplementary Demands for Grants, which the Lok Sabha passed despite the Opposition’s outrage over a variety of issues.

The government was authorised to spend an additional Rs 3.73 lakh crore during the current fiscal year under the Supplementary Demands for Grants.

Fugitive businessman and prime accused in the Rs 14,000 crore PNB scam, Nirav Modi is currently lodged in the Wandsworth jail in southwest London and has been denied bail on four occasions. Modi had been arrested in London on March 20, 17 months after he fled India. Meanwhile, Mallya owes over ₹9,000 crores to a consortium of banks in principal and interest.

|

ED recovers 80.45% of bank losses from assets of Vijay Mallya, Nirav Modi, and Mehul Choksi

It may be noted that until July, a consortium of banks led by the State Bank of India (SBI) had recovered Rs 792.11 crores from fugitives and wilful defaulters such as Vijay Mallya, Nirav Modi, and Mehul Choksi.

As per reports, the banks sold the shares of the three businessmen that were handed to them by the Enforcement Directorate (ED). The central agency had confiscated their assets under the stringent Prevention of Money Laundering Act (PMLA). According to ED, it has recovered ₹13,109.17 crores through the sale of its assets to banks, out of ₹9,371 crores worth of assets was handed in June. Till date, a total of assets worth ₹18,170.02 crores have been confiscated by the Enforcement Directorate, which constitutes 80.45% of the total loss to banks.

References:

opindia.com - OpIndia Staff

Support Us

Support Us

Satyagraha was born from the heart of our land, with an undying aim to unveil the true essence of Bharat. It seeks to illuminate the hidden tales of our valiant freedom fighters and the rich chronicles that haven't yet sung their complete melody in the mainstream.

While platforms like NDTV and 'The Wire' effortlessly garner funds under the banner of safeguarding democracy, we at Satyagraha walk a different path. Our strength and resonance come from you. In this journey to weave a stronger Bharat, every little contribution amplifies our voice. Let's come together, contribute as you can, and champion the true spirit of our nation.

|  |  |

| ICICI Bank of Satyaagrah | Razorpay Bank of Satyaagrah | PayPal Bank of Satyaagrah - For International Payments |

If all above doesn't work, then try the LINK below:

Please share the article on other platforms

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text. The website also frequently uses non-commercial images for representational purposes only in line with the article. We are not responsible for the authenticity of such images. If some images have a copyright issue, we request the person/entity to contact us at This email address is being protected from spambots. You need JavaScript enabled to view it. and we will take the necessary actions to resolve the issue.

Related Articles

- Piyush Goyal claimed that Indian Textile Industry has potential to achieve $100 Billion in exports by 2030: Says new agreements with Australia and UAE open infinite opportunities for Indian industries

- State-of-the-art Maharaja Bir Bikram Airport Terminal is inaugurated by Prime Minister Narendra Modi in Agartala: Follow Details to know more

- Exports of India's Merchandise mounts to Historic High Of $37.29 Billion in Dec 2021, Apr-Dec 2021 Figures Nearly $300 Billion

- Modi govt announces incentive scheme for RuPay and BHIM-UPI after Visa complained to US govt about Indian govt promoting RuPay

- 'The Monk Who Transformed Uttar Pradesh and The Monk Who Became Chief Minister': Noted Author, Shantanu Gupta, who wrote bestsellers on Yogi Adityanath reached the USA for a multi-city book tour amid UP elections

- 'Balasaheb has taught us – The one who challenges should be broken. Even Modi would not have been spared if he had challenged Matoshree the way Kirit Somaiya did': Shiv Sena leader Dipali Sayyed

- Ministry of External Affairs summons South Korea Ambassador over the pro-terror stance of Hyundai Pakistan on Kashmir and expressed strong displeasure of the Government: Korean Minister Yong exhibit regret

- ‘Inappropriate question’ on Gujarat riots asked in class 12 sociology exam: CBSE promises strict action

- Marriage acts of Christian, Muslim, other groups too will be amended to ensure only Hindus don’t end up following new marriage age for women: Sources

- Car manufacturers Celebrating Pro-terrorism stand on Kashmir has invited massive criticism from National auto dealers’ body: Urges the Ministry of Heavy Industries & SIAM India to seek clarifications

- A major boost to India’s defence system, the Philippines has accepted BrahMos Aerospace Pvt Ltd’s proposal worth USD 374.9 million: India’s proposal to supply Brahmos anti-ship Missile System gets green signal

- Jan Ki Baat opinion poll survey shows clear victory for Yogi Adityanath as the CM of UP in 2022: BJP set to get a comfortable majority

- Congress created magic on paper to make 17 crores poor by changing the estimated poverty line in a rural area and urban area: PM Modi tears into Congress’ ‘Garibi hatao’ facade, exposes the reality of 2013 report

- Delhi Govt completes liquor license allotment in all 32 zones under new excise policy; earns ₹8,900 crore

- Clensta, a D2C Home Care Startup Raises Series A Funding